By Peter Michael, MyInvestment.Blog

Over the past few years, socio-economic hardship has been leaking petrol on the FIRE movement, making it not just a popular buzzword, but a common life goal amongst millennials.

So, what is the FIRE movement, and what does it stand for?

Financial Independence, Retire Early (FIRE) is exactly what it sounds like. It is a plan on how to reach a certain amount of wealth where you no longer need to work in order to sustain your living.

The goal here isn’t to be lazy and void of meaningful work, but it is that you have the choice for that to be the case, if you want to.

Because, when you take away the necessity of working to pay your rent, you can open up yourself to projects that you find meaningful and fulfilling.

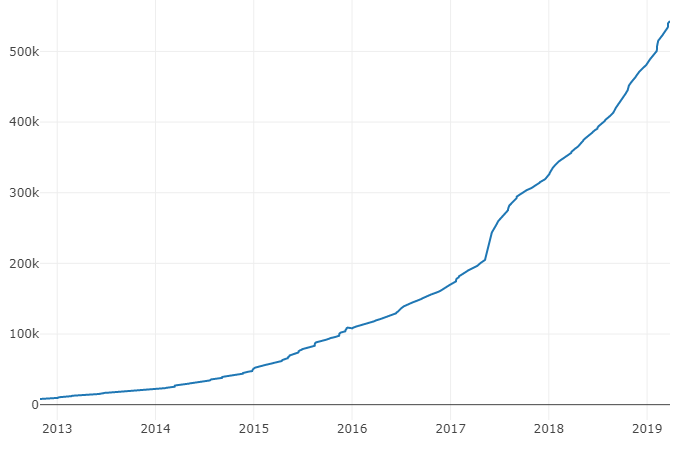

Despite some tough economic times with austerity being present in many countries, increasingly there are people more financially ambitious in spite of a squeezed middle class. As we can see below, the FIRE subreddit reflects this accelerating growth in the movement.

Financial Independence subreddit subscriber growth

FIRE is giving power to individuals to take back control of their own fate, in an age where it is easy to become politically disillusioned and uncertain of our future.

More than that, though, is that it provides us with a process. It is a kind of open-source process, too. Through blogs and online communities, it is common to share your plan to early retirement. This is where you get advice and tips on how to better your own plan, as well as ask others if you are going in the right direction.

The two key aspects to FIRE are saving and investing (though, we should pay off our debts before we save). These two are crucial in building up enough wealth that we can one day live from.

The saving aspect is more of an attitude whilst investing is more technical (but not necessarily complicated). This is because when we set out to save more, we are reconditioning ourselves to have a more honest picture of what we actually need in life.

As you become more frugal, you become more self-aware and thoughtful, making you less materialistic, which makes it easier to continue saving – the opposite of a vicious cycle!

Investment on the other hand is a little more scientific. We can read, understand and share tips on investing which will essentially maximise the value of our savings. Investing and saving are therefore connected, with it being difficult to invest if you aren’t actively trying to save.

Investments that will give us a greater return will generally come at higher risk, which is when things become a little more complex. However, low risk investing can be incredibly simple, and is the very minimum that is required to grow your savings.

Because of the different sub-topics within it, even if FIRE isn’t a key goal of yours, you can still find great money saving tips within it, or advice on how to create a diverse and strong portfolio of investments.

This movement has in a sense produced a highly effective, open-sourced process that is entirely transparent – and we have the liberty to pick-and-choose aspects that suit our own circumstances, such as our differing appetites for investment risk.

7 steps to FIRE

Here are my 7 steps towards financial freedom or FIRE. Some will take a longer time than others, but the order is what is important here:

- Small emergency fund – roughly 1000 EUR or 1000 USD to cover any disasters and emergencies

- Pay off high-interest loans – this is stopping you from saving, get rid of it ASAP

- Strong emergency fund – roughly enough to cover 1 or 2 months worth of living. This is also the step when you start investing.

- Pay off any other loans – 60% of your savings should pay off your student loans, financed cars etc. whilst the remaining 40% should be invested

- Pay off the mortgage – start aggressively paying off your mortgage to become debt free with the same 60/40 split.

- Be totally debt free – this is a big milestone, and now you can start investing 100% of your savings.

- Be financially independent – step 6 meant that your savings rate and investments have skyrocketed, making step 7 easier than it appears

Key tips

Low effort investing

Index funds are a great choice for investors who want more of a return than low risk bonds can offer, but do not want the risk or effort of investing in individual stocks.

Index funds are a basket of stocks or bonds that are created to track the index of a specific market. Due to the wide selection of stocks, the risk is somewhat diversified. This means that the risk of one stock crashing would not significantly affect the whole portfolio, as the risk is spread.

The funds are put together by professionals, and investing in one takes minimum effort for that reason. Of course investing is worth putting the effort in, but to get started as a beginner, the burden, pressure and risk that is associated with choosing and researching your own specific investments can be mitigated by letting a fund manager do this for you.

Savings ratio

The savings rate is the percentage of income you save and invest. This runs through the heart of FIRE.

Those fortunate and dedicated enough can often reach savings rates into the 90s.

It is important to not compare too much to other peoples, but treat it as a game against yourself. By trying to increase it each year, you are training yourself to become a more rational person who is less tempted by materialism.

It is also great training for your retirement, and after a few years of practicing frugality, you may conclude that your retirement budget can be less than what you planned, meaning you get to retire earlier. Many people aim for a retirement budget of around 25 times their yearly spend.